Which accounting account is the rescue agreement fee of nonprofit organization recorded in

.jpg)

Revenue Recognition of Grants and Contracts by NotforProfit

Accounting for contributions is an issue primarily for notforprofit entities because contributions are a significant source of revenue However, the amendments in the Update apply to all organizations that receive or make contributions of cash and other assets, including business In this chapter we shall learn about the accounting aspects relating to notforprofit organisation NotforProfit Organisations refer to the organisations that are for used for the welfare of the Accounting for NotforProfit Organisation NCERTlaunch the Accounting Guide for NonProfits, the outcome of our Financial Accounting Standards for NonProfit Organizations Project, which we launched two years ago This project began as Accounting Guide for NonProfits PCNCThis guide addresses the accounting and reporting for notforprofit entities under US GAAP This guide summarizes the applicable accounting literature, including relevant references to and About the Notforprofit entities guide Full guide PDF Viewpoint

64 The basic accounting for contributions Viewpoint

The basic rules in accounting for contributions are summarized below A contribution involves a donor, a donee, and a simultaneous transfer of benefit The donor or “resource provider” is the 2024年11月20日 On a global level, accounting for nonprofits follows the same accounting principles (formally, Generally Accepted Accounting Principles) as forprofit businesses; Accounting Basics for Nonprofits A Primer for NonFinance LeadersFinancial statements in the NFP sector can involve accounting methodologies not found in the forprofit sector NFPs are very diverse and range from small allvolunteer groups to large highly A Guide to Financial Statements of NotforProfit OrganizationsWhen an NFP provides goods or services in exchange for consideration from a customer, ASC 606, Revenue from Contracts with Customers applies ASC 606 replaces substantially all of 124 NFPspecific revenue streams Viewpoint

.jpg)

Nonprofit Organization Accounting SpringerLink

2023年4月7日 Nonprofit organizational accounting refers to the rules, standards, and conventions that govern how nonprofits treat and record financial transactions as well as how Notforprofit organizations are impacted by various guidance in the FASB Accounting Standards Codification® and by many of the projects currently on the FASB’s technical agenda New NotforProfit Financial Reporting Standards FASB2024年5月9日 Overview of Nonprofit Revenue Recognition Nonprofit organizations operate under accounting principles tailored to their distinct structure and revenue streams A key aspect of nonprofit accounting involves How NonProfit Organizations Should Recognize 2024年5月9日 Overview of NonProfit Grant Accounting Nonprofit organizations often deal with various grants that come with their own set of financial reporting requirements Grant accounting is a specialized process within the nonprofit How NonProfits Handle Accounting for Grants:

.jpg)

Nonprofit Revenue Recognition Part 1 of 2

2020年8月3日 Nonprofit organizations typically follow two patterns for entering income: All income is recorded as cash is received, or; Some income is recorded as cash is received while other income is recorded as invoiced to customers 2024年7月31日 Donors and grantgiving organizations: Donors and grantgiving organizations like foundations must trust that your organization will prudently spend and account for the money they give you Volunteers: Volunteers must trust that they’re sharing their efforts with a worthwhile, responsible organization and that their hard work isn’t in vainA Guide to Accounting for a Nonprofit Organization business2014年5月13日 DR: Current Contra Debt Account – Loan Fees $4,000 DR: NonCurrent Contra Debt Account – Loan Fees $16,000 CR: Cash $20,000 For our illustration and for simplicity purposes, each year, amortize 1/5th of the fee and group the amortization with interest expense on the Company’s income statement DR: Interest Expense $4,000Accounting for Loan Origination Fees Meaden Moore2022年7月28日 How does ASC 842 impact inkind rent? Many nonprofit organizations receive rent as an inkind gift, meaning their landlord donates rentable space at no cost to the nonprofitHistorically, inkind rent is treated as any other inkind contribution; inkind revenue is recorded in conjunction with a corresponding inkind expense on the statement of activitiesNew Rules For Nonprofit Lease Accounting: ASC 842 Explained

(PDF) BASIC ACCOUNTING FOR NONPROFIT MAKING ORGANIZATIONS

2019年5月11日 The primary aim of this study is to examines, "the basic accounting for nonprofit making organizations: chemical society perspective" Nonprofit organizations are organizations whose objective 2019年10月23日 When you’re numbering your accounts, follow these three rules: Keep things simple You don’t need separate accounts for paper, pens, envelopes, and staples; you can just have one account for office supplies If you need more detailed layers of organization, you can add class codes Group similar accounts togetherA Sample Chart of Accounts for Nonprofit OrganizationsStudents of class 12 Accountancy should refer to MCQs Class 12 Accountancy Not for Profit Organizations with answers provided here which is an important chapter in Class 12 Accountancy NCERT textbook These Multiple Choice Questions have been prepared based on the latest CBSE and NCERT syllabus for Class 12 AccountsMCuestions Class 12 Accountancy Not for Profit Organizations2023年12月15日 Accrual vs Cash Basis Accounting for Nonprofits There are two main types of accounting for nonprofits: the accrual method and the cash basis method Accrual Method: The accrual method records revenues as they are earned or pledged Likewise, expenses are recorded when they are incurredHow to Properly Record Revenue for Nonprofits The Charity CFO

.jpg)

Principles of Accounting: Accounting for non profit organisations

2023年1月24日 Consequently an Accumulated Fund account is used in non profit entities instead of a Capital Account; The name accumulated fund is used because this fund is likely made up of funds that accumulated overtime rather than a normal capital injection; Income Statement in non profit entities Often non profit organisations have profit making concernsIn accordance with ASC 958605252 (donee) and ASC 72025251 (donor), at that time, the recipient recognizes contribution revenue (an increase in its net assets) and the donor recognizes contribution expense Note that if the contribution involves a promise to give, the transfer of benefit occurs in the period the promise is made (and accepted), not when the actual transfer 64 The basic accounting for contributions Viewpoint2018年6月27日 Updated August 30, 2021 Because an animal sanctuary is first and foremost typically a nonprofit organization, it’s critical that you create and maintain organizationwide record keeping policiesAnimal Sanctuary Organizational Record Keeping BasicsA nonprofit organization is defined as an organization whose primary purpose is to serve its members for the benefit of the group or society in general Table of Contents * Introduction to nonprofit organizations * Private Foundations * Private Operating Foundations * What is the purpose of Fund accounting for nonprofit organizations? * How isAccounting for a NonProfit Organization Deskera

ACC 4100 CH 18 Flashcards Quizlet

Study with Quizlet and memorize flashcards containing terms like 1 Reciprocal transfers where both parties give and receive something of value are A) Donated supplies and materials B) Unconditional promises to give C) Endowment transactions D) Exchange transactions E) Required contributions, 5 Which account should be credited to record a gift of cash which is 2024年9月17日 An extraprovincial nonshare corporation is a notforprofit organization that has been incorporated or formed federally, or in another province or country They must register within 2 months of starting to conduct activities in BC Once registered, they need to maintain the registration in BCNotforprofit organizations Province of British ColumbiaADVERTISEMENTS: The Final Accounts of nontrading concerns consists of: 1 Receipts and Payments Account 2 Income and Expenditure Account, and ADVERTISEMENTS: 3 Balance Sheet 1 Receipts and Payments Account: It is a Real Account It is a consolidated summary of Cash Book It is prepared at the end of the accounting period All cash receipts []Accounts of NonProfit Organisation (An Overview) Your 2019年12月9日 Introduction to the Non Profit Chart of Accounts The chart of accounts for a non profit organization differs from a normal business in that the balance sheet is referred to as the statement of financial position, the income statement is referred to as the statement of activities or statement of operations, and as the non profit organization is governed by trustees and does Non Profit Chart of Accounts Double Entry Bookkeeping

Accounting for Humane Societies and Animal Shelters

2019年10月4日 Humane Societies and other animal shelter and rescue organizations have unique accounting needs based on the nature of the services they provide to humans and animals alike Home you must account for the value of the noncash donation Other Revenue In addition to donations, animal shelters often take in revenue from adoption fees2021年8月12日 As we note in our video on the Tax Implications of the Employee Retention Credit, there are two pathways to qualification for the ERC: a significant decline in gross receipts from the reference quarter in 2019, or full or partial suspension of services due to a governmental order related to COVID19Under both the suspensionofservices test and the grossreceipts Accounting and Reporting for the Employee Retention CreditIn this chapter you will learn how to prepare the financial statements of nonprofit making organisations Accounting Tuition The types of incomes and expenses of these organizations vary according to their needs Typical examples include the following incomes: subscription, membership fee, registration fee; profits from running a bar Chapter 7 Non profit making organisations Accounting TuitionAccounting Guide for NonProfits from the Financial Accounting Standards for NonProfit Organizations Project Published by the Asia Pacific Philanthropy Consortium Rm 208 CSPPA Bldg Ateneo De Manila University Loyola Heights, 1108 Quezon City, Philippines Tel (632) 426 6001 ext 4645 Fax (632) 426 1427 Web asianphilanthropyAccounting Guide for NonProfits PCNC

.jpg)

Contract Account Definition, Format, Treatment, and

2023年3月3日 Similarly, profit or loss arising from the sale of the plant or materials should also be transferred to the profit and loss account by way of abnormal items The other items to be shown on the credit side of the contract Let us make indepth study of the meaning and features of Income and Expenditure Account of NotForProfit organisations Meaning of Income and Expenditure Account: Income and Expenditure Account is a nominal account and includes only those items which are revenue in nature Items which are revenue in nature (nominal accounts) and pertaining to the present Income and Expenditure Account of NotForProfit Organizations2020年8月19日 Nonprofits Nongovernmental organizations whose primary purpose is something other than selling goods or services can make profits – but all of this profit must be put back into the organization! When most people hear “nonprofit,” they also tend to assume “taxexempt” – that is, an organization exempt from paying certain taxes and that may afford tax Starting A Nonprofit Organization For Animal Sanctuaries In The 2024年5月25日 Proper management of purposerestricted funds is crucial for maintaining donor trust and ensuring that the organization can continue to attract targeted donations Accounting for Restricted Funds Accurate accounting for restricted funds is fundamental to maintaining the financial health and integrity of a nonprofit organizationManaging Restricted Funds: Types, Accounting, and Reporting

Nonprofit Accounting Explained: HowTos Best Practices

2023年7月17日 Setting up a fund accounting system for a nonprofit organization consists of creating separate funds (aka accounts) for the various programs and outreach efforts of the organization Fund accounting provides tracking for nonprofits to reflect funds donated or granted, with and without restrictions2023年6月5日 3 Best Practices for Nonprofit Accounting While your nonprofit bookkeeper records daytoday financial information for your organization, your nonprofit accountant is responsible for reviewing bookkeeping entries, performing account and balance sheet reconciliations, preparing financial statements and reports, and reviewing the financials with Nonprofit Accounting: A Guide to Basics and Best PracticesThe main difference between forprofit and nonprofit accounting lies in the objective of the organization Forprofit firms aim to maximize profits, while nonprofits focus on the organization’s mission Nonprofit accounting involves GAAP rules for fund accounting, which is not used in forprofit businessesNonprofit Accounting: Essential Principles and Best Practices1991年1月1日 Footnote 3 Also, an organization that is not a nonprofit organization under the ITA may be a nonprofit organization under the ETA where there is a specific statutory requirement that mandates different treatment The only area where the statutory schemes mandate different treatment is the rebate available under section 259 for Crown agentsDetermination of whether an entity is a nonprofit organization

Part III — Accounting Standards for NotforProfit Organizations

Section 1501 Firsttime adoption by notforprofit organizations: Section 1501, First Time Adoption by NotforProfit Organizations, provides guidance on preparing the first set of financial statements under Part III of the Handbook Accounting Standards for NotForProfit Organizations (ASNPO) Effective January 1, 2021prepare their final accounts at the end of the accounting period and the general principles of accounting are fully applicable in their preparation as stated earlier, the final accounts of a ‘notforprofit organisation’ consist of the following: (i) Receipt and Payment Account (ii) Income and Expenditure Account, and (iii) Balance SheetAccounting for NotforProfit Organisation Byju'sNotforprofitseeking entities exist to provide services to the members or to the society at large Such entities might sometimes carry on trading activities but the profits arising there from are used to further the service objectives 12 Accounting for Financial Statements of Notfor 2022年1月13日 The estimated market value gets recorded as both revenue and an expense on your profit and loss statement Let’s say you received $10,000 worth of legal services, here’s how you could record that donation: Record the $10,000 donation to a revenue account (example: “InKind Gift Revenue: Service”)Accounting for InKind Donations to Nonprofits The Charity CFO

.jpg)

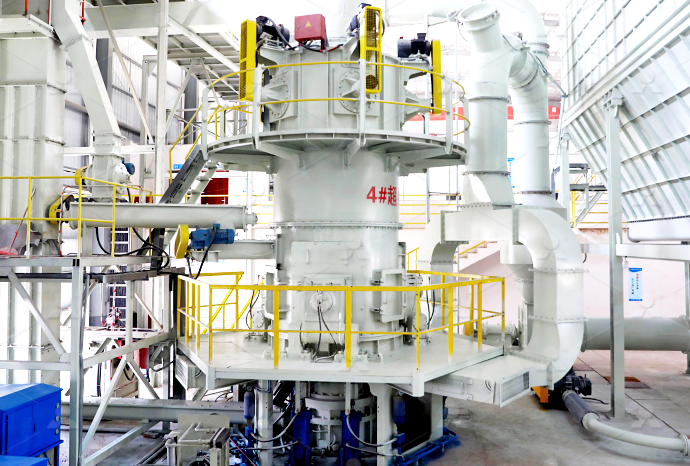

Nonprofit Accounting for Animal Rescues Don Wilson CPA

Nonprofit accounting is focused on accountability Transparency in your animal rescue organization’s finances is required by donors, for grant compliance, and to satisfy the general public To make sure your books are always in order, turn to the accountants at Don Wilson CPA PC We specialize in nonprofit audit services and accounting Nonprofit organizations registered under 2013 Features It is a revenue account prepared at the end of the accounting period for finding out the surplus or deficit of that period It is The Subscription Account is closed off by transferring its balance at the end of the year to the Income and Expenditure Account Life Membership FeeICAI Notes Chapter 9: Financial Statements of NotforProfit4 天之前 How to Account for Membership Fees In the examples just described, the Securities and Exchange Commission (SEC) has stated that there is rarely any specific value obtained by a customer in exchange for an upfront fee That being the case, such revenue should be recognized on a deferred basis that is linked to the greater of the remaining terms of the Membership fee accounting — AccountingToolsprofit corporations, they are regarded as business entities for accounting and reporting purposes Question NP 13 addresses the question as to whether a caption such as “members’ equity” precludes application of ASC 958 Question NP 13 A notforprofit insurance entity was formed to provide coverage to notforprofit member organizationsNotforprofit entities 2020 Viewpoint

Misappropriating Nonprofit Funds A Look At Restricted Donations

2024年7月22日 There are two types (or buckets) of funds, restricted and unrestricted Let’s take a look at each: Restricted Funds: These are funds that are set aside for a particular purpose Sometimes it’s temporarily restricted, meaning that the restriction could end due to a specified time limit, or more likely, by the completion of a project, such as the construction of a facility2021年7月14日 Pledges receivable allows nonprofit organizations to recognize and account for revenue that donors have promised to give in the form of donations at some point in the future The way that nonprofits account for these kinds of promises depends heavily on whether they’re considered “conditional” or “unconditional”PLEDGES RECEIVABLE: HOW TO ACCOUNT FOR PLEDGES