HOME→Which account should the machine parts be included in Which account should the machine parts be included in Which account should the machine parts be included in

Which account should the machine parts be included in Which account should the machine parts be included in Which account should the machine parts be included in

How to Account for Spare Parts under IFRS CPDbox

Sometimes, you can have an asset that is used in the production process for more than 1 period, but its acquisition cost is very small And sometimes, you can have a huge amountof similar spare parts or servicing equipment For example, small tools, moulds, pallets or 展开2021年11月8日 Spare parts under IFRS are generally recognized as inventories However, if the entity expects these spare parts to be used for more than the accounting period, and the Accounting recognition of spare parts under IFRSItems such as spare parts, standby equipment and servicing equipment are recognised in accordance with this IFRS when they meet the definition of property, plant and equipmentProperty, Plant and Equipment IAS 16 IFRS2018年4月14日 In May 2012 International Accounting Standards Board (IASB) as part of its annual improvement program 20092011 amended paragraph 8 of IAS 16 ‘Property, Plant and IAS 16 – Accounting of spare parts, standby equipment and

IAS 16 — Property, Plant and Equipment

IAS 16 recognises that parts of some items of property, plant, and equipment may require replacement at regular intervals The carrying amount of an item of property, plant, and The company needs to have a spare part to replace when machine breaks down Some companies record spare parts as expenses when they are used to repair the machinery They Accounting for Spare Parts Inventory (Journal Entry)IAS 16 establishes principles for recognising property, plant and equipment as assets, measuring their carrying amounts, and measuring the depreciation charges and impairment losses to be IAS 16 Property, Plant and Equipment IFRS2024年4月12日 The decision on accounting for subsequent expenditure frequently depends on whether an existing part of PPE is replaced or if new functionality is added IAS 16 gives Cost of Property, Plant and Equipment (IAS 16)

.jpg)

Spare parts, residual value and depreciation in the context of fixed

2020年1月9日 In the example described, the company should consider service costs as the costs of current maintenance of the machine, ie refer it to the profit and loss account and IAS 16 governs the accounting for property, plant, and equipment (PPE) These are tangible asset that are (IAS 166): Expected to be used during more than one (annual) period PPE is IAS 16 PPE: Scope, Definitions and Disclosure2024年4月12日 The decision on accounting for subsequent expenditure frequently depends on whether an existing part of PPE is replaced or if new functionality is added IAS 16 gives more specific direction with spare parts, Cost of Property, Plant and Equipment (IAS 16)Study with Quizlet and memorize flashcards containing terms like Which of the following should not be included in direct materials costs for a bike manufacturer?, Machine lubrication oil The three major costs of manufacturing a product are: Direct materials, Materials that are crucial parts of a finished product are called:acct 2 Flashcards Quizlet

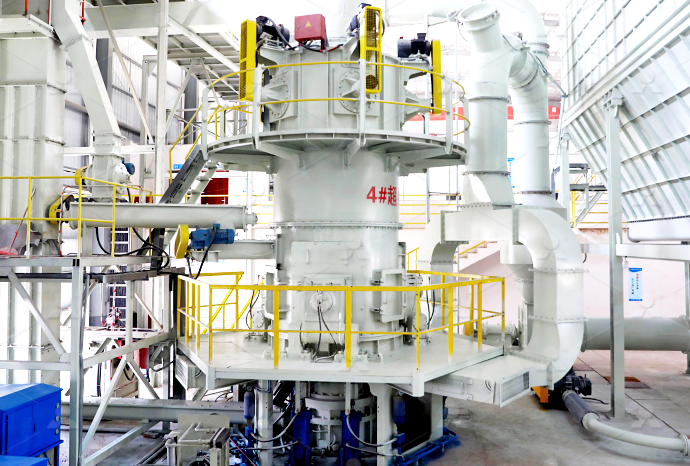

CFB石灰石脱硫剂制备96.jpg)

Disscussion intacc chap 1 Intermediate Accounting 1

The Inventory account is under the current assets section of the statement of financial position It is recorded at its lower of cost and net realizable value 6 Which of the following items would be included in the inventory account of a 2024年6月13日 The capitalization of repair costs is unusual, and should be cleared in advance with the company's auditors to prevent disputes over the classification of these costs during the annual audit When in doubt, it is likely that these costs should be expensed Best Practice for Equipment Repairs AccountingHow to account for repairs to factory equipment — AccountingToolsDiscuss which of the following should be included in the cost of equipment: a) installation charges, b) freight charges, c) cost of building foundations, d) new parts needed to replace those damaged while unloading, e)borrowing costs incurred to finaWhich of the following would not be included in the cost of a new Question: Which of the following would not be included in the Equipment account? Installation costs Freight costs Cost of trial runs Electricity used by the machine Show transcribed image text Here’s the best way to solve it SolutionSolved Which of the following would not be included in the

.jpg)

Machine Hour Rate: Meaning, Types and Computation Cost Accounting

The amount payable in each instalment towards the cash price of the machine should not be included in the computation of the machine hour rate, as it is capital expenditure, and not revenue expenditure However, as regards the amount payable in each instalment towards the interest, there is difference of opinion among authors2021年11月8日 For this reason, the 5,000 spare parts should be recognized as inventory and accounted for in profit and loss as they are consumed In summary, if an entity concludes that a replacement part has a significant price and is expected to be used for more than one accounting period, it will be recognized as property, plant, and equipment If, on the Accounting recognition of spare parts under IFRSHow to Account for Repairs Maintenance Under GAAP Repairs and maintenance are expenses a business incurs to restore an asset to a previous operating condition or to keep an asset in its current How to Account for Repairs Maintenance Under GAAPWhich of the following should be included in the acquisition cost of a piece of equipment? The acquisition of a new machine with a purchase price of $109,000, would be journalized with a debit to the asset account for lessor In a lease contract, the party who legally owns the asset is Acc Ch 10 Flashcards Quizlet

Which of the following would not be included in the Equipment account

Discuss which of the following should be included in the cost of equipment: a) installation charges, b) freight charges, c) cost of building foundations, d) new parts needed to replace those damaged while unloading, e)borrowing costs incurred to finaSince depreciation spreads the machine’s cost to depreciation expense over the life of the machine, the impact on the company’s profit may be relatively small in the first accounting year compared to the cost of the machine Example of How does the purchase of a new machine affect thePart 3: Summary and detailed examples This is the final article in the series of three which consider the accounting for property, plant and equipment by applying IAS ® 16, Property, Plant and EquipmentThis is a particularly important area of the Financial Reporting (FR) syllabus and is also important assumed knowledge for the Strategic Business Reporting (SBR) examProperty, plant and equipment ACCA GlobalIs the installation labor for a new asset expensed or included in the cost of the asset? For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting onlineIs the installation labor for a new asset expensed or included

.jpg)

Discuss which of the following should be included in the cost of

Discuss which of the following should be included in the cost of equipment: a) installation charges, b) freight charges, c) cost of building foundations, d) new parts needed to replace those damaged while unloading, e)borrowing costs incurred to finance These assets are capitalized in the books of account and are depreciated over the useful 2018年12月10日 Something else to consider usually companies set up a threshold for recording fixed assets For example, maybe $300 is the amount anything less than that would be an expense and not set up as a fixed asset For example, a stapler should last more than a year, but we wouldn't set it up as a fixed asset and calculate depreciation on itSolved: We bought a refrigerator for the office What account Account Debit Credit; Repair and Maintenance Expense: 1,000: Cash: So it should be capitalized as the assets The journal entry is debiting fixed asset $ 20,000 and credit cash Account Debit Credit; Fixed Assets: 20,000: Cash: 20,000: It will increase the fixed asset on balance sheet while decreasing the cashAccounting for Repair and Maintenance Journal EntryStudy with Quizlet and memorize flashcards containing terms like Which of the following should be included in the acquisition cost of a piece of equipment? a installation costs b transportation costs c testing costs prior to placing the equipment into production d All of these choices are correct, Which of the following is included in the cost of constructing a building? a cost of Exam 5 Accounting Extra Credit Flashcards Quizlet

.jpg)

Calculating the Machine Hour Rate Finance Strategists

2023年3月3日 To compute the machine hour rate, each machine or a group of similar machines in a production department is considered a smaller department, and departmental expenses are reapportioned to the machines or groups of machines in the department To this end, the following fundamental factors should be considered: (i) Base Period2024年2月22日 As discussed in PPE 12, costs to be capitalized for longlived assets include directly attributable costs that are incurred for the construction or acquisition of the longlived assetThe treatment of certain types of costs may require judgment See PPE 151 for a discussion of the accounting for customer reimbursements, PPE 152 for preproduction 15 Other costs to be considered for capitalization Viewpoint5 Which of the following items should be included in a company's inventory account at the balance sheet date? Goods in transit to our company, which were purchased FOB shipping A point B Goods received from another company Solved 5 Which of the following items should be Study with Quizlet and memorize flashcards containing terms like Which of the following is included in the cost of a plant asset? A) amounts paid to make the asset ready for its intended use B) replacement of damaged parts of the asset C) regular repair and maintenance costs D) wages of workers who use the asset in normal operations, Bachman, Inc plans to develop a Acc Practice Exam 3 Flashcards Quizlet

Which of the following would not be included in the Equipment account

2023年11月16日 The Equipment account refers to the category in a company's financial statements that records the cost of acquiring and maintaining equipment used in the operations of the business Out of the given options, electricity used by the machine would not be included in the Equipment accountTo determine which of the given options should NOT be included in the inventory account, evaluate each option based on inventory accounting principles Requirement 1 (Question No4 per screen above): The correct answer for the question is Option A Goods held on consignment from another companySolved 4 Which of the following should NOT be included in CheggStudy with Quizlet and memorize flashcards containing terms like Which of the following inventories carried by a manufacturer is similar to the merchandise inventory of a retailer? a Raw materials b Workinprocess c Finished goods d Supplies, Which of the following methods is also referred as "parking transactions"? a Consignment sales b Sales on installment c CH 8 ACCTG Flashcards Quizlet2024年7月23日 In the second shipment of 80 machine parts, 10 percent were defective: Number of defective parts in the second shipment = 10% of 80 = (10/100) * 80 = 8 Now, let's calculate the total number of machine parts and the total number of defective parts in the combined shipments: Total number of machine parts = 120 + 80 = 200In a shipment of 120 machine parts, 5 percent were defective

Solved Which of the following should not be included as part Chegg

Question: Which of the following should not be included as part of the cost pool of machine setups? Cost of the accounts payable supervisor's salary Depreciation on machines and parts used for different setups Supplies needed in changing machines from one production setting to another Salaries of those supervising machine operators14 Machine parts are assembled in a factory One of the components used to assemble machine part MP12 is 17 A bank account pays a nominal 40% per annum with interest payable every six months What operational annual net cash inflow should be included in the capital investment appraisal? A $90,000 B $120,000 C $170,000 D $200,000Certified Accounting Technician Examination ACCA Global2016年2月19日 Initial accounting: spare parts should be capitalized However, similar to accounting for other property and equipment, you will probably want to set a capitalization threshold such that you are not capitalizing small items like belts, hoses, etc Either that, or just treat these small spare parts as suppliesAccounting For Spare Parts Proformative2020年1月9日 According to IAS 16, such machine components can be depreciated separately, ie for a machine we can apply a 4% depreciation rate, and for an engine 15% Depreciation charges are recognized in the profit and loss account Spare parts, residual value and depreciation in the context of fixed

.jpg)

Solved 19 Which of the following would not be

19 Which of the following would not be included in the Equipment account? A) Cost of trial runs B) Installation costs C) Freight costs D) Electricity used by the machine 20 Nix Corporation sold equipment for $20,000 The equipment had Study with Quizlet and memorize flashcards containing terms like Which TWO of the following should be taken into account when determining the cost of inventories per IAS2 Inventories ? 1 Storage costs of partfinished goods 2 Trade discounts 3 Recoverable purchase taxes 4 Administrative costs, According to IAS2 Inventories, which TWO of the following should be IFRS36 Inventories IAS2 Flashcards Quizletthe entity should account for the dry docking cost as below: • Cost of replacing parts: If the costs of replacing parts meets the recognition criteria in Ind AS 16, the entity should capitalise those parts in the carrying amount of the ship as a separate component and derecognise the replaced parts These parts will be depreciatedEducational material on Ind AS 16, Property, Plant and EquipmentWhich of the following would not be included in the cost of a new machine? A Freight cost incurred in having the machine delivered B Sales tax paid on the new machine C Cost of installing the machine D All of the above would be included in the cost o; Indicate which of the following costs should be expensed when incurredWhich of the following would not be considered part of the cost of

.jpg)

15 Other inventory costing matters Viewpoint

Other inventory costing matters ASC 70520 provides accounting guidance on how a customer (including a reseller) of a vendor's products should account for cash consideration (as well as sales incentives) received from a vendor Under the provisions of ASC 70520251, cash consideration received by a customer from a vendor is a reduction of the price of the vendor's 2024年6月15日 Costs Not to Assign to a Fixed Asset The following costs should not be assigned to a fixed asset: Administration and general overhead costs Costs incurred after an asset is ready for use, but has not yet been used or is not yet operating at full capacity Costs incurred that are not necessary to bring the asset to the location and condition necessary for it Which costs to assign to a fixed asset — AccountingTools2021年6月4日 When you first purchase new equipment, you need to debit the specific equipment (ie, asset) account And, credit the account you pay for the asset from Let’s say you buy $10,000 worth of computers and pay in cash Debit your Computers account $10,000 and credit your Cash account $10,000Purchase of Equipment Journal Entry (Plus Examples) Patriot Indicate which costs to acquire a printing press should be included in the cost of the assets 1 Freight 2 Special foundation 3 Which of the following would not be included in the Equipment account: a Installation costs b Freight costs c Cost of trial runs d Electricity used by the machine D Electricity used by the machineSurvey of Financial Accounting Flashcards Quizlet

Accounting 1 Multiple Choice Flashcards Quizlet

Study with Quizlet and memorize flashcards containing terms like Which of the following would not be included in the Equipment account? a Installation costs b Freight costs c Cost of trial runs d Electricity used by the machine, The cost of land does not include: a real estate brokers commission b annual property taxes c accrued property taxes assumed by the purchaser d All of the following are included in the acquisition cost of property, plant, and equipment except: a transportation costs b taxes on the purchase c installation costs d maintenance costs Which of the following would not be included in the Equipment account? a Cost of trial runs b Freight costs c Electricity used by the machine dWhich of the following should be included in the acquisition cost