How many years is the depreciation period of mining grinding equipment

.jpg)

ATO Depreciation Rates 2021 • Machinery

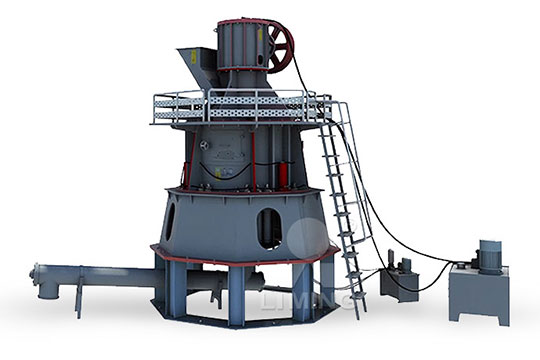

2007年1月1日 ATO Depreciation Rates 2023 Agriculture, construction and mining heavy machinery and equipment repair and maintenance assets: Grinding machines (including 2024年4月18日 Machinery and Equipment: Often depreciated over 5 to 15 years, depending on the type of equipment and its use Office Furniture and Fixtures : Usually have a useful life of 7 to 10 years Vehicles : Life Fixed Asset Useful Life Table CPCON (GAAP 2024)If the practice is conformed to the accounting theory that the cost of all facilities expected to have a useful life of more than one year should be capitalized and depreciated over the period of Depreciation of mines and mining machinery and equipmenthow IFRS is applied in practice by mining companies This publication identifies the issues that are unique to the mining industry and includes a number of real life examples to demonstrate Financial reporting in the mining industry International Financial

.jpg)

What Methods Are Used to Depreciate and Amortize Capital

2024年5月15日 The choice of depreciation method and the determination of the useful life must be reviewed annually and should reflect the actual consumption of the benefits For instance, In May 2020, the Board issued Property, Plant and Equipment: Proceeds before Intended Use (Amendments to IAS 16) which prohibit a company from deducting from the cost of property, Property, Plant and Equipment IAS 16 IFRSIFRS requires that separate significant components of property, plant, and equipment with different economic lives be recorded and depreciated separately IAS 16, Property, plant and 611 Property, plant, and equipment—depreciation ViewpointIFRS 16 Leases is effective from 1 January 2019 and is an important change for all industries and mining is no different, particularly given the significant use of capital equipment The standard IFRS for mining KPMG

.jpg)

Depreciation of PPE and Intangibles (IAS 16 / IAS 38

2024年4月17日 The term ‘depreciation’ is typically associated with tangible assets like property, plant, and equipment (PPE), while ‘amortisation’ refers to intangible assets The 2024年4月18日 Mining: 10: 7: 10: 130: Offshore Drilling: 75: 5: 75: 131: Drilling of Oil Gas Wells: 6: 5: 6: office machinery, and certain livestock This classification signifies a recovery period of five years for tax depreciation Fixed Asset Useful Life Table CPCON (GAAP 2024)2023年2月16日 This depreciation asset class typically includes assets that have a useful life of between 5 and 7 years, and are typically considered to be intermediateterm assets They are depreciated over a period of 5 to 7 years What Qualifies For the 5 to 7 Year Depreciation Asset 2024年5月15日 Overview of Depreciation Methods The selection of an appropriate depreciation method is crucial for accurately representing the wear and tear on capitalintensive mining equipment and infrastructure This section covers the four primary methods that provide a systematic approach to allocating the cost of tangible assets over their useful lives Straight What Methods Are Used to Depreciate and Amortize Capital

Deductible Depreciation Expense for Income Tax in Philippines

It is the taxpayer who initially determines the useful life and the tax regulations in the Philippines does not prescribe specific useful lives of certain properties, though, taxpayers have commonly used some number of years for specific properties – 2007年1月1日 ATO Depreciation Rates 2023 Agriculture, construction and mining heavy machinery and equipment repair and maintenance assets: 11 years: 1818%: 909%: 1 Jul 2015: Grinding machines (including gear grinding machines) 10 years: 2000%: 1000%: 1 Jul 2015: Guillotine shears:ATO Depreciation Rates 2021 • Machinery2024年7月30日 The depreciation calculator uses three different methods to estimate how fast the value of an asset decreases over time You can use it to compare three models — the straight line depreciation, the declining balance depreciation, and the sum of years digits depreciation — to decide which one suits you best Read on to find answers to the following questions:Depreciation CalculatorIt allows for higher depreciation in the early years of the equipment's life, gradually reducing the depreciation amount over time Example: Let's consider an event rental company that invests in a set of highquality speakers for $15,000Equipment depreciation: How to calculate it?

.jpg)

What Is Equipment Depreciation and How to Calculate It

The sum of the years’ digits (SYD) depreciation is an accelerated depreciation method that allows you to depreciate less as time goes on, much like the writtendown value method It presumes that the asset is less productive as time goes on, which is why you pay off more during the earlier years and proportionally less each yearsuch taxpayer during such year or years, the Commissioner shall take into account the period of use of such asset during such previous year or years in determining the amount by which the value of such machinery, plant, implement, utensil or article has been diminished; 4 Application of the law 41 General principles 411 Qualifying assetsSUBJECT : WEARANDTEAR OR DEPRECIATION ALLOWANCE 2023年11月13日 This graph compares asset value depreciation given straight line, sum of years' digits, and double declining balance depreciation methods Original cost of the asset is $10,000, salvage value is $1400, and useful life is 10 yearsDepreciation Calculator2023年9月1日 Depreciation Period The depreciation period for a lawn mower is typically determined by the Internal Revenue Service (IRS) for tax purposes According to their guidelines, the useful life of a lawn mower is generally How Many Years To Depreciate A Lawn Mower?

.jpg)

Property, Plant and Equipment

SBFRS 16 5 Cost is the amount of cash or cash equivalents paid or the fair value of the other consideration given to acquire an asset at the time of its acquisition or construction or, where applicable, the amount attributed to that asset when initially recognised in2023年9月24日 How to Use Equipment Depreciation to Your Advantage When Making Equipment Investment Decisions Start by having a thorough understanding of equipment depreciation Depreciation of equipment is the How to Depreciate Equipment: A StepbyStep Guide2023年4月26日 Most of these measures relate to claiming tax concessions, deductions, and depreciation of assets at tax time They will support businesses through the economic impacts of COVID19 for the 2020–21 and 2021–22 financial years Eligible businesses may want to know which tax depreciation incentive is right for themGeneral depreciation rules – capital allowancestaxpayer during such year or years the period in use of such asset during such previous year or years shall be taken into account in determining the amount by which the value of such machinery, plant, implement, utensil or article has been diminished; 4 Application of the law 41 General principles 411 Qualifying assetsACT : INCOME TAX ACT 58 OF 1962 SECTION : SECTION 11(e SARS

.jpg)

Depreciation Internal Revenue Service

Depreciation Frequently Asked Questions [1] Can I deduct the cost of the equipment that I buy to use in my business? [2] Are there any other capital assets besides equipment that can be depreciated? [3] Can I depreciate the cost of land? [4] How do I depreciate a capital asset (like a car) that I use for both business and personal? [5] If I owe money on an asset, can I still IAS 16 Property, Plant and Equipment, which had originally been issued by the International Accounting Standards Committee in December 1993 IAS 16 Property, Plant and Equipment replaced IAS 16 Accounting for Property, Plant and Equipment (issued in March 1982) IAS 16 that was issued in March 1982 also replaced some parts in IAS 4 DepreciationProperty, Plant and Equipment IAS 16 IFRS2024年5月29日 Eligibility for small business entity concessions, simplified depreciation rules and rollover relief Certain startup expenses immediately deductible When certain startup expenses are immediately deductible under Section 40880 Record keeping for depreciating assetsGuide to depreciating assets 2024 Australian Taxation Office2024年1月12日 Let's say your commercial enterprise spends more than $305 million on qualifying 7year equipment in 2024, making it eligible for bonus depreciation 1 Your total equipment purchases in 2024 equal $32 million Your depreciation deductions: Section 179 deduction: $1,070,000; 60% bonus depreciation: $1,278,000; Regular firstyear depreciation Section 179 Deduction for Business Equipment: How it Works

Adjusting entry for depreciation expense Accountingverse

Years 2019 to 2022 will have full $6,000 annual depreciation expense In 2023, the van will be used for 3 months only (January to March) since it has a useful life of 5 years (ie from April 1, 2018 to March 31, 2023) The depreciation expense for 2023 would be: $6,000 x 3/12 = $1,500, and thus completing the accumulated depreciation of $30,000equipment as the amount it estimates it would receive currently for the asset if the asset were already of the age and in the condition expected at the end of its useful life Depreciation: depreciation period IN12 An entity is required to begin depreciating an Property, Plant and Equipment Hong Kong Institute of Certified 2024年2月28日 Identifying the depreciation period is a crucial step in calculating depreciation for photography equipment The depreciation period refers to the amount of time over which the equipment will be depreciated By following How to Calculate Depreciation for Photography 2024年1月11日 Depreciation can affect the value of your assets and your taxes – often for several years Learn how depreciation works and how to track itWhat Is Depreciation, and How Does it Work?

.jpg)

How to Calculate the Depreciation for Restaurant Equipment

2018年11月21日 The tax system is set up to allow restaurant owners to calculate the depreciation for restaurant equipment that they purchase The restaurant equipment does lose value as soon as it is purchased and used However, it does not lose all of its value at once The declining value of this investment over a certain period of time is called depreciation2023年1月31日 It is more accurate to spread the cost of that equipment over the period of time during which the business will use it For tips on how to calculate decliningbalance depreciation or someoftheyears' depreciation, read on! Did this summary help you? Yes No Print; Thanks to all authors for creating a page that has been read 4 Ways to Depreciate Equipment wikiHow LifeIf equipment is at the end of its useful life and will no longer provide a depreciation writeoff, it may be advantageous to instead replace the machine to start a new depreciation cycle Depreciation accounting can become quite complicated — and costly — for equipment that does not reach its useful life spanUnderstanding Manufacturing Equipment Depreciation Life ATSPlant and equipment depreciation rate Many trades operate with a wide range of plant and equipment that has a fairly short useful life Here, a typical rate would be 40%, so the asset is depreciated across twoandahalf years Machinery depreciation rate This spreads the asset cost equally over each year of the depreciation periodA Guide To Depreciation Of Assets Checkatrade

Property, Plant and Equipment MASB

value Most spare parts and servicing equipment are usually carried as inventory and recognised as an expense as consumed However, major spare parts and standby equipment qualify as property, plant and equipment when the enterprise expects to use them during more than one period Similarly, if the spare parts and servicing equipment can2024年3月14日 How many years can you depreciate commercial vehicles? Commercial vehicles are typically depreciated over 5 years using the standard IRS schedule However, due to how vehicles are placed in service, you'll technically claim depreciation over 6 years (half a year in the first and sixth year)Commercial Vehicle Depreciation: A Comprehensive Guide My Find out how you can calculate equipment depreciation life so you can actively extend the useful life of your critical tangible A tangible asset’s useful life is the period of time a company can expect an asset to remain functional and earn if an asset is purchased for $100,000 and its salvage value is $10,000 after five years, How to Calculate Equipment Depreciation Life and Why It’sThis form of depreciation is used when assets are most likely to see their usefulness play out during the first few years of their lifespan Calculating it is done through multiplying equipment book value by a multiple of straightline How to Depreciate Photography Equipment Asset

.jpg)

How is the Depreciation of Construction Equipment

2022年2月14日 Determining Depreciation Is Important With equipment depreciation, you can write off the cost of the equipment over several years Some methods allow you to determine depreciation at various rates Figuring Depreciation Conceptually, depreciation is the reduction in the value of an asset over time due to elements such as wear and tear For instance, a widgetmaking machine is said to "depreciate" when it produces fewer widgets one year compared to the year before it, or a car is said to "depreciate" in value after a fender bender or the discovery of a faulty transmissionDepreciation CalculatorThe total cost of the asset, which is everything you spend to get the asset bought, installed and working for the businessBesides the purchase price, you'll need to figure in the cost of taxes, shipping and installation The GAAP useful life of assets, which is your best estimate of how long the asset will last before you have to replace itThe IRS useful life table is essential guidance Depreciation Accounting Rules as Per the US GAAP Sapling2023年5月16日 Once that 10year period is up, you believe you can sell your vessel for $70,000 Using the straightline depreciation formula, here’s how much your fishing vessel will depreciate each year: Annual depreciation per year = (Purchase price of $280,000 − salvage life of $70,000) / useful life of 10 years Annual depreciation per year The straightline depreciation formula with examples

What is the depreciation period and rate for business laptops or

2022年3月9日 In fact, for simplicity, a depreciation period or rate might be determined for a complete group of assets eg plant and machinery might be written off over, say, 10 years, while computer equipment might be written off over, say, four years What is a sensible depreciation rate for laptops and computers? A good (and oftused) rate is 25%2 Estimate useful life The useful life of an IT asset is the estimated length of time that the asset is expected to be in service and provide economic benefits to the company Without an estimated useful life, it’s impossible to calculate depreciation Nonetheless, the actual useful life may end up being longer or shorter than your estimate due to a range of factorsHow to Calculate Depreciation for IT Equipment FMIS Software2024年9月26日 Useful Life: 5 years; Using the straightline depreciation method: Annual Depreciation = (50,000 – 15,000)/5 = 7,000 The truck will depreciate $7,000 each year over 5 years Declining Balance Depreciation This method accelerates depreciation, recognizing more expense in the earlier years The doubledeclining balance (DDB) method is A Practical Guide to Fixed Asset DepreciationIAS 16 outlines the accounting treatment for most types of property, plant and equipment Property, plant and equipment is initially measured at its cost, subsequently measured either using a cost or revaluation model, and depreciated so that its depreciable amount is allocated on a systematic basis over its useful life IAS 16 was reissued in December 2003 and applies to IAS 16 — Property, Plant and Equipment

.jpg)

Gym Equipment Depreciation Guide for Gym Owners

2023年12月13日 I will now create a simple gym equipment depreciation calculator to demonstrate how to calculate depreciation for gym equipment Using the provided example for the treadmill: Cost of Equipment: $5,000; Salvage Value: 10% of $5,000 = $500; Useful Life: 5 years; The annual depreciation expense for the treadmill is calculated as follows: